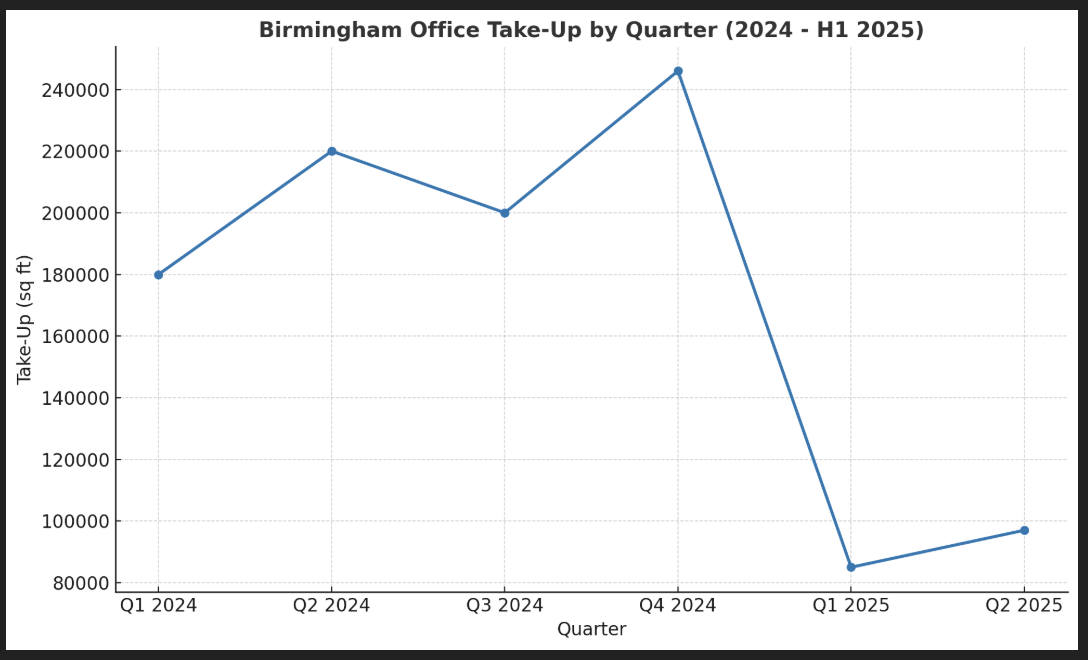

The Birmingham office market has been one of the UK regions to watch over the last 18 months. After a strong 2024 – when annual take-up climbed to levels not seen in several years – the first half of 2025 has been more mixed: a quieter start to the year followed by signs of a rebound in activity. Below, we’ve pulled together the latest publicly available figures, explain what’s driving demand (and where it isn’t), and set out what that means for occupiers, landlords and fit-out teams working in and around the city.

Snapshot — the numbers you need to know

- 2024 total take-up: Birmingham recorded circa 846,000 sq ft of office take-up across the year, a level noted by market commentators as one of the strongest annual totals for several years.

- H1 2025: The city had a subdued start to 2025, with H1 take-up reported at roughly 182,800 sq ft across c.38 transactions (KWB’s H1 review). That represented a material drop against recent multi-year averages, though analysts caution that H1 can be distorted by the timing of a handful of large deals.

- Q2 2025 signs of life: Several regional reports show a quarter-on-quarter rebound — Q2 take-up rose significantly on Q1 levels (Colliers noted a Q2 increase and other compilers recorded Q2 city-centre figures in the 110–120k sq ft zone). This suggests deal flow is returning as occupiers move faster on quality space.

These numbers tell a story of a market that enjoyed momentum in 2024, corrected in early 2025, and is now moving back toward normalisation — but the recovery is selective and very quality-led.

City centre vs out-of-town — where activity is concentrated

Historically, Birmingham city centre draws the lion’s share of corporate occupiers looking for transport connectivity, profile and amenities. In 2024 that pattern continued, and while out-of-town transactions still play an important role (especially for occupiers prioritising parking/industrial adjacency), the premium has shifted even more strongly towards high-quality, well-specified city centre space.

Reports from regional brokers and agents show that when demand returns, occupiers chase grade A or recently refurbished stock rather than older, poor-quality buildings. That creates a two-tier market: strong take-up and rental pressure at the top end, and longer marketing times (or the need for landlord investment/refurbishment) for secondary stock.

Which sectors are driving demand?

Take-up in the Birmingham office market is not uniform — the footprint of demand varies by sector and by quarter. The headline sectoral trends are:

- Public sector & education: This has been a recurring source of activity in specific quarters. For example, KWB’s Q3 2024 breakdown highlighted a quarter when education-related deals accounted for a substantial portion of take-up. More generally, civic and institutional occupiers remain significant market players.

- Professional services (legal, accountancy, consultancy): Professional services continue to be steady occupiers of regional office space. They tend to favour central locations with good client access and quality meeting/boardroom facilities. Industry reporting across 2024–25 consistently flags professional services as a major occupier group.

- Tech and life sciences: Birmingham’s tech scene and growing life-sciences cluster are increasingly important demand drivers. Local providers and innovation-led landlords reported increased interest in lab-enabled and specialist workspace over 2024, and city boosters see both sectors as long-term growth engines for office demand. This is particularly noticeable for flexible workspace and smaller HQ or satellite office requirements.

- Financial services: Banking and finance still feature, though their footprint has been more conservative compared to pre-pandemic peaks. When large deals occur, they skew take-up figures, but overall the profile here is caution combined with selective expansion for premium space.

In short: education/public and professional services provide a steady baseline demand, while tech and life sciences are the growth stories to watch. When those growth sectors commit to larger or higher-specification leases, they have a notable positive impact on headline take-up figures.

Why quality matters more than ever

Multiple market commentaries point to a clear theme: a rush for quality. Occupiers are prioritising sustainability credentials, modern M&E, flexible floorplates and wellbeing features — and they’re prepared to pay a premium for them. Vacant secondary stock without refurbishment is at a disadvantage and often requires landlord investment (Cat A / Cat A+ upgrades) or conversion to alternative uses to compete.

For Estilo Interiors and other fit-out providers, this has practical consequences:

- More demand for Cat A+ and turnkey Cat B solutions that shorten mobilisation time for occupiers.

- Greater emphasis on sustainability credentials (low-carbon materials, energy-efficient M&E, WELL/LEED features).

- Increased appetite for flexible, modular furniture and demountable partitions so occupiers can scale or reconfigure quickly.

Pricing and rental implications

Prime and well-specified stock is tightening, which pushes rental growth at the top end even in a cautious macro environment. Several brokers are noting rental stabilisation and selective uplifts in prime rents across regional centres, Birmingham included. That creates a competitive dynamic: occupiers either secure high-quality space quickly (often on shorter lead times) or accept compromises in location/amenity.

What this means for occupiers, landlords and fit-out teams

- Occupiers: Plan earlier and prioritise quality. If sustainability and amenity are part of your employer value proposition, budget for slightly higher rents or consider fit-out investment to convert a near-prime space.

- Landlords: Upgrading to Cat A+ specification (or offering turnkey Cat B options) will materially improve marketability and shorten void periods. Green credentials pay off.

- Fit-out contractors and designers (that’s you): Position services around speed, flexibility and sustainability. Offer modular, re-configurable solutions and partner with M&E specialists to deliver low-carbon outcomes that align with occupier and investor expectations.

Final thoughts

The Birmingham office market is showing the classic characteristics of a post-pandemic, quality-led recovery: when occupiers commit, they choose better buildings; when deals slow, the secondary stock is the first to lag. 2024 proved there is real demand for the city’s office product; 2025’s quieter H1 simply underlines that take-up is timing-sensitive and concentrated in specific sectors. Early signs of a Q2 rebound suggest momentum can return — especially where landlords and fit-out teams deliver the high-quality, sustainable environments modern occupiers want.